How to Print Paychecks Again in Quickbooks

Every employee receives a W-2 class at the end of the fiscal year by his employer. It is a argument that contains information related to the salary/wages that an employee is paid by his employer. Besides, information technology as well tells about the deduction of taxes from his paychecks. All this information is required by the employee for preparing his tax returns. Your employer keeps different copies of this form and forwards it to three different parties: the federal government, the state government, and the employee. No matter whether you're a QB desktop or an online payroll user, you tin print the W-2 grade in both versions of QuickBooks. Before you go along with the printing process, yous need to sympathize the Due west-2 grade and its importance.

If you need an expert'south aid to print W-2 in QuickBooks, and then you must go in affect with our team. Give us a call on our Asquare Cloud Hosting Helpline Number and nosotros volition provide y'all instant back up.

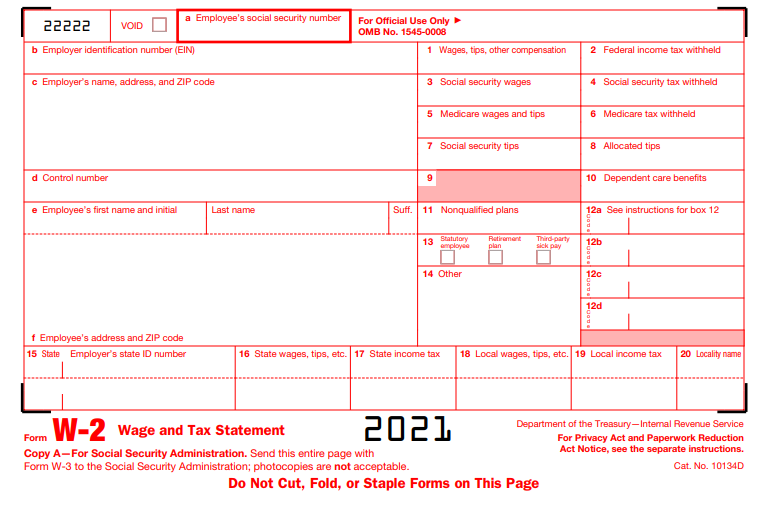

What Is A W-2 Form?

W-2 Grade is also known as the Wage and Tax Argument course. Information technology is a certificate that an employer has to transport to all his employees and the Internal Acquirement Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes retained from their paychecks. A W-two employee is someone whose taxes are deducted from their paychecks by his employer, and he further submits this information to the authorities.

An employer must send the Due west-2 form to every employee to whom they pay bacon, wage, or another form of compensation. It doesn't account for contracted or self-employed workers, as they file taxes with different forms. The W-2 course must be sent on or before January 31 each year then that one has sufficient fourth dimension for filing the income taxes before the deadline, i.e., Apr xv (in near years). One files the revenue enhancement documents for the previous yr. For instance, say you received a West-2 form in January 2021. It signifies the income that you earned in 2020.

NOTE: If y'all are amidst those affected by the Feb 2021 snowstorm disaster in Texas, you must know that the deadline for tax filing has been postponed to June 15, 2021. You lot are eligible for the extension even if yous don't live in Texas merely were afflicted by the storm.

Requirements to Print W-2 Grade in QuickBooks

Beneath, nosotros take mentioned some of the basic requirements yous must fulfill before creating employee W2 in QuickBooks and print it.

- Use the updated version of QuickBooks while printing the W-2 course. The QB version must be uniform with the Windows OS installed on your desktop.

- The QuickBooks Payroll Service must be agile.

- The W-2 paper must be uniform with the payroll service and the printer.

- You tin can either employ blank or perforated newspaper or the pre-printed form of light amplification by stimulated emission of radiation printer. Besides, you lot tin can also utilize pre-printed inkjet printer newspaper.

- Make sure to have the latest release of the payroll tax tabular array.

Verify the Payroll Service You're using Earlier Get-go Press Westward-2

Earlier you begin to print the Due west-two form in QuickBooks, information technology'southward essential for you to know about the version of QuickBooks Payroll that you are currently using, as the process may vary for each version. Still, if you are dislocated and aren't aware of it, then yous must follow the below-given steps:

- Firstly, sign in to QuickBooks Online.

- Get to the settings and select the Accounts and Settings option, followed by Billing Subscription and Payroll.

- Now, click on Plan details, and you will become to know the payroll plan y'all currently have.

- If it shows Enhanced or Basic, it signifies QuickBooks self-service payroll.

- Whereas, if it is Full-service payroll, then information technology means you have QuickBooks Full-service payroll version.

However, if yous are a QuickBooks desktop payroll user, yous must follow the steps mentioned here to know about your current payroll service.

How To Print Due west-2 For Employees In QuickBooks?

The steps y'all demand to follow to print the Due west-2 grade in QuickBooks solely depend on your conclusion whether you want to pay and file your federal and country payroll taxes on your own or want Intuit Quickbooks to do it for y'all. If you aren't sure about it, and then you must go through your automated taxation payments and form filing status in the start identify.

Notation: The option of press W-ii forms is not available in the QuickBooks desktop payroll bones version. Thus, y'all take to upgrade to another version, such as QuickBooks desktop payroll enhanced.

Two Means To Print W-2 Form In QuickBooks:

As mentioned, there are different versions of QB payroll available. Out of these, some services requite you the option to pay and file the tax for you while using others yous can pay on your own. No affair which service you have, we got you covered. Basically, there are 2 means of printing the W-2 form in QuickBooks depending upon the below-mentioned conditions.

- When Intuit QuickBooks Pays and File your taxes For you.

- When You Pay and File your taxes on your own.

Condition 1: Print W2 When Intuit QuickBooks Pays and File Taxes for you

If you lot are using a payroll service that falls under this category, you don't need to worry about the filing procedure. All will exist taken intendance of by the QuickBooks payroll service. If you lot're using whatsoever of the beneath-mentioned payroll services, and so Intuit will file taxes for you:

- QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite

- QuickBooks Online Payroll Total Service

- Intuit Online Payroll Total Service

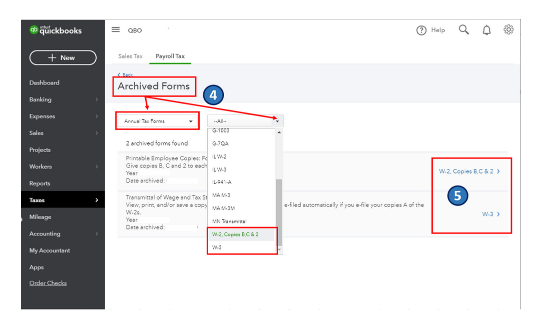

Intuit mail all your employees the W-2s starting January xx through January 31. However, if you want information technology from Jan 13, yous tin can re-print information technology on plain paper. For that, you may follow the below-given steps:

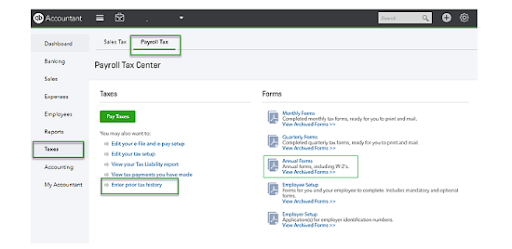

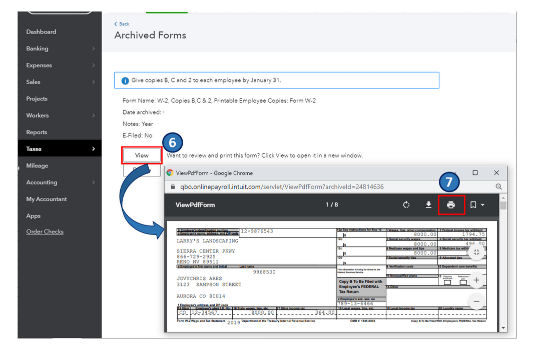

- Open up QuickBooks Online and go to the Taxes carte du jour.

- At present, select the Payroll Tax choice followed by Filings and Annual Forms.

- Here, you will accept the option of press both employer and employee copies of your W-2s and W-3.

- Employer Copies: Form W-2 (West-two, Copies A & D), Transmittal of Wage and Taxation Statements (Due west-3)

- Employee Copies: Class Westward-ii (W-2, Copies B, C & two).

- If you oasis't prepare up your W-2 printing preferences past now, a prompt volition appear on your screen: Before filing this form, you lot must gear up upwardly West-2 printing. Click on it and select your paper.

- Further, select the required filing period from the dropdown menu.

- Open Adobe Reader in a new window by clicking on View.

- Select the impress icon from the Reader toolbar. So, click on the Print pick once again.

NOTE: If your employee lost or didn't get the original West-2, then you have to reprint the course. In that case, you take to write a REISSUED STATEMENT on top of it. Along with that, also attach a copy of the W-2 instructions.

Condition 2: When You Pay and File your Taxes on your own

Beingness an employer, you need to impress and mail W-2s to your employees postmarked by Feb ane if the payroll service you lot are using falls under this category. We have listed all the related services below:

- QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite

- QuickBooks Online Payroll Enhanced

- QuickBooks Desktop Payroll Enhanced, QuickBooks Desktop Payroll Standard.

- Intuit Online Payroll Enhanced

Yous demand to follow certain steps if you want to file and pay the tax manually or using whatsoever of the above stated payroll services.

Pace 1: Purchase your Due west-ii paper

If you plan to order the Due west-2 kits, we would suggest yous give our services a try. For that, you need to follow these steps:

- Firstly, go to QuickBooks check and supplies and select Revenue enhancement products followed by Blank W-ii kits.

- To place your order, follow the instructions that prompt on your screen

We assure y'all that it will permit yous print the Westward-2 course in QuickBooks without any mistake, and thus, none of your employees would have any bug. You can print the employee copy on either of these papers:

- Blank 3-part perforated newspaper

- Blank iv-role perforated paper

Once you have the W-2 paper, you need to set your printing preferences. And, for that, y'all must proceed to the next step.

Stride 2: Ready Your Printing Preferences

Yous tin can change or set your printing preferences past following the below-given steps:

- Go to settings and select the payroll settings option.

- From the W2 print preference tab, click on Edit.

- Lastly, select your paper type and click on OK.

NOTE: However, this step varies for QuickBooks Desktop Payroll Enhanced and Standard service users. For these, you have to update QuickBooks desktop and payroll tax table as per the latest available version. It helps QuickBooks to calculate the correct tax amount as per the current tax rates.

Now, y'all're all gear up to print the W-2 forms. To know how, go to the next step.

Step 3: Now Impress the Filed W-ii Forms in QB

If you have decided to file and pay the tax on your ain, so you lot must impress your W-2s from the start of January 1.

- At outset, select Taxes followed by Payroll Tax.

- Now, select the Filings pick and then select Annual Forms.

- At this signal, you will have the choice to print both employer and employee copies of your Due west-2s and W-3.

- Employer Copies: Form W-ii (W-two, Copies A & D), Transmittal of Wage and Tax Statements (W-iii)

- Employee Copies: Grade W-2 (W-ii, Copies B, C & 2).

- A prompt volition pop up stating Earlier filing this form; you must gear up W-2 printing if you wouldn't accept set your W-ii printing preferences. Click on it and select your printing paper.

- Farther, select the required filing catamenia from the dropdown.

- Click on View to open the Adobe Reader in a new window. Then, select the print icon on the Reader toolbar.

- Lastly, select the Print choice once again.

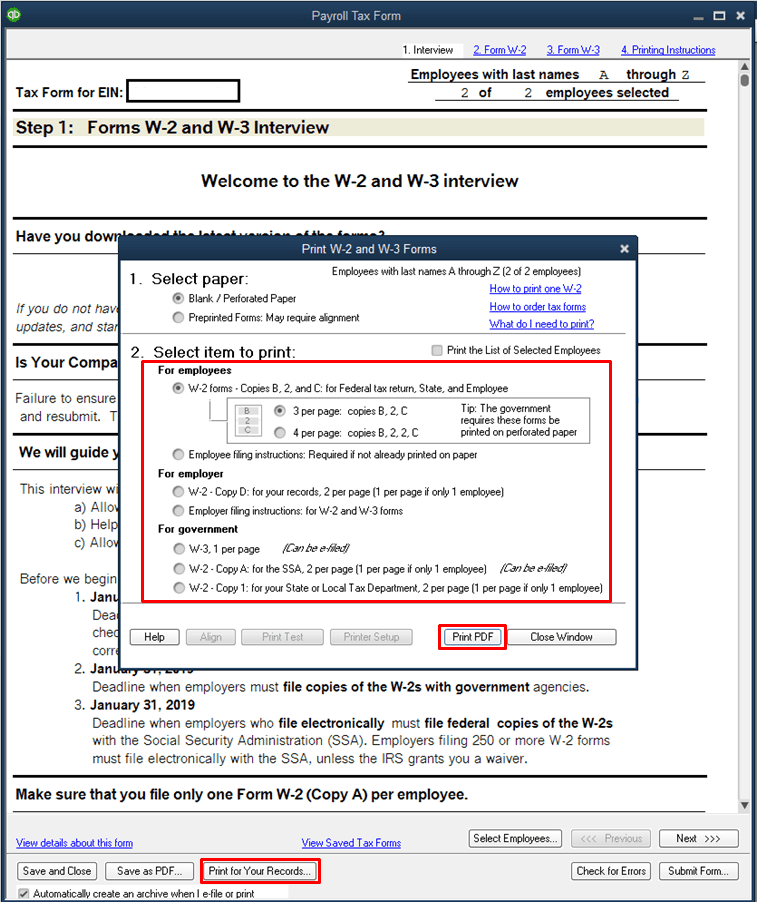

Important: The concluding stride slightly differs for the QuickBooks Desktop Payroll Enhanced, QuickBooks Desktop Payroll Standard version. For this service, you need to follow the below-given steps:

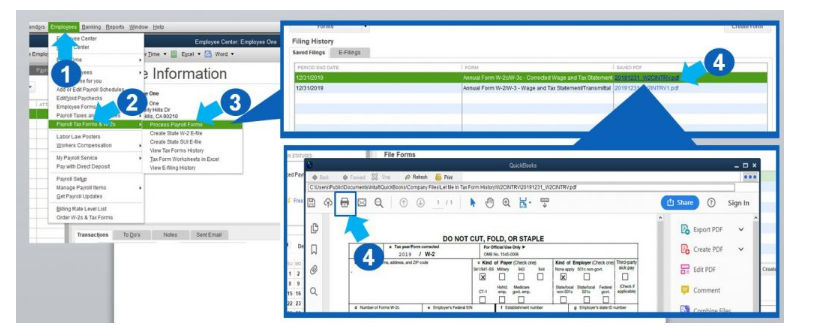

- Select Payroll Tax forms & Due west-2s followed by Procedure Payroll Forms from the Employees dropdown carte.

- Scroll down from the File forms tab and select Annual Grade W-2/W-three – Wage and Tax Statement/ Transmittal.

- Now, click on the Create grade option and select all or individual employees to file.

- Mention the year and click on OK.

- Again, either select all or private employees to print.

- Make sure to review each W-2 past clicking on Review/ Edit. A bank check mark identifies these Due west-2s in the reviewed cavalcade.

- At last, select the submit form pick and print and file the class past post-obit the on-screen instructions.

Notation: Every bit mentioned earlier, you lot have to write REISSUED Statement on the top of your Due west-2 copy if your employee lost or didn't receive the original Westward-2 form. Besides, brand sure to attach the W-2 instructions copy.

How Can You Print West-2 Form In QuickBooks Desktop Payroll Assisted With Self Impress Choice?

Wondering how to print the W-2 form in QuickBooks while using the Payroll Assisted version on your QuickBooks Desktop! It's possible with the Self Impress option past following the given steps.

- Follow the beneath-given steps to open the Payroll Tax eye:

- Open QuickBooks and click on Payroll Center nether the Employees menu.

- Click on the File Forms tab and select the View / Impress Forms & W-2s option.

- Then, enter your payroll PIN.

- Now, click on the W-2 tab.

- If you want to impress forms for all the employees, click on the checkbox confronting the Employee. Else yous may select the specific employee names.

- Click on the Open/Save Selected option.

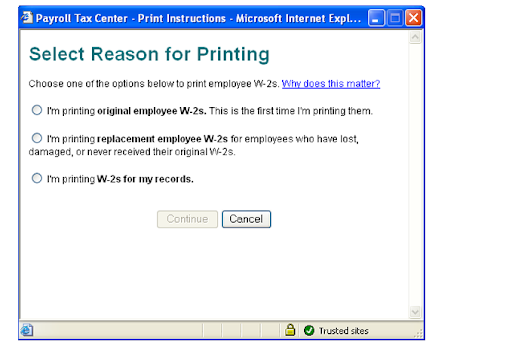

- Choose the specific reason for press the W-2s when the Print Instructions window appears on the screen.

- If the employee is receiving the Due west-two for the first time, click on I'm printing original employee W-2s option.

- However, select the I'thou printing replacement employee Due west-2s pick if the Westward-2 form is lost or damaged.

- If you are press the W-ii for the visitor records, select the last choice I'thou printing Due west-2s for my records.

- Based on what you select in the last footstep, a bulletin related to printing paper will appear on your screen. Thus, you lot accept to load the correct paper into your printer.

Annotation: If you don't have the perforated newspaper (it has the instructions for filing the Due west-2 forms on the back) at the time of printing W-two form, you lot can print it on plain paper with the status that you provide appropriate W-2 filing instructions to your employee.

- When the Adobe Reader file opens with your West-2 selections, click on the File menu and select Print to print the Due west-2s.

Important: You lot must know that the QB Desktop Payroll Assisted uses iv-up paper (four horizontal W-2s per page).

Need Help in Printing West-two Forms!

We have tried our best to explain the procedure to impress W-2 form in QuickBooks desktop and online in the easiest mode. Nevertheless, it might be a scrap tricky for some users. In such a situation, we would suggest you accept professional person assist from our experts past placing a call on Asquare Cloud Hosting Helpline Number. Our team is available round the clock to provide firsthand back up.

Frequently Asked Questions almost W2 Class Press

1. Tin can yous print w2 forms in QuickBooks on plain paper?

You can print Westward-2 form in QuickBooks in either of these papers: blank or perforated paper and pre-printed W-2 forms.

ii. How to receive w2 from the previous employer online?

You can follow the below steps to get Westward-two from your previous employer online:

a). Firstly, you take to check the payroll. Y'all can get Due west-2 past calling or sending an email to the payroll administrator.

b). At concluding, you can make a call to the IRS.

3. How can I written report an employer if he hasn't sent W-two?

Follow these steps if you want to report an employer for not sending you the W-two:

a). At start, you must contact your employer.

b). And then, contact the IRS squad if you lot haven't received your W-ii form past February 14th.

4. How to get my W2 from my previous job?

If that's the case, then you must call or e-mail your payroll administrator. Further, you lot also have to ostend your mailing address. Else, you lot can place a call to the IRS.

5. What happens if I don't get my W2 past Jan 31?

If you haven't received your W-two by Jan 31, and then you must follow these steps:

a). Contact your employer in the first place.

b). And then, endeavor to get in affect with the IRS.

c). After that, you have to file your render, followed by Form 1040X.

Source: https://asquarecloudhosting.com/how-to-print-w-2-form-in-quickbooks-desktop-online-explained/

0 Response to "How to Print Paychecks Again in Quickbooks"

Publicar un comentario